Zilingo and Investor Idiocy

From unicorn to donkey

Zilingo is a superstar startup in freefall and potentially a sign of things to come. But the lesson here isn’t about the downfall of the company. It’s about the complete failure of venture investors and how often this keeps happening. I hope to outline why time is a flat circle when it comes to startup failures, and why this won’t change anytime soon.

TL;DR

Classic startup story. ‘Tech’ (eCommerce should be a separate category honestly) unicorn, raises oodles of money, promises the world, delivers (mostly) nothing.

Investors previously mention they decided not to back Zilingo after they found evidence of merchant fraud in Indonesia (which accounted for more than half of Zilingo’s GMV in the FY2021 mind you).1 Yet other investors continue to plough money into the startup.

Leadership, especially Ankiti Bose, are (were?) quasi celebrities. Bose and co-founder Dhruv Kapoor were named on Forbes 30 Under 30 Asia in 2018, Bose was featured in the Singapore 100 Women in Tech List in 2020, and Bose has also been a speaker at several global and regional conferences. Bose, the confident, charismatic leader was a natural media star. (Am I allowed to make a Theranos comparison?) Edit: and in this Substack’s first ever scoop, I’ve heard of brown nosing so bad that there’s been unironic Steve Jobs comparisons. My sides!)

In the span of three months, from May to July this year, Zilingo’s CEO, COO, and CFO have all left. (CEO was technically fired).

Zilingo’s future now looks about as bright as the north pole in the dead of winter. Investors live to see another day and face no real scrutiny.

The Players:

Ankiti Bose: High-flying ex-CEO, co-founded Zilingo, previously an investment analyst at Sequoia Capital India.

Dhruv Kapoor: Co-founded Zilingo, Chief Technology and Product Officer there. Previously a Software Engineer at Kiwi and Yahoo.

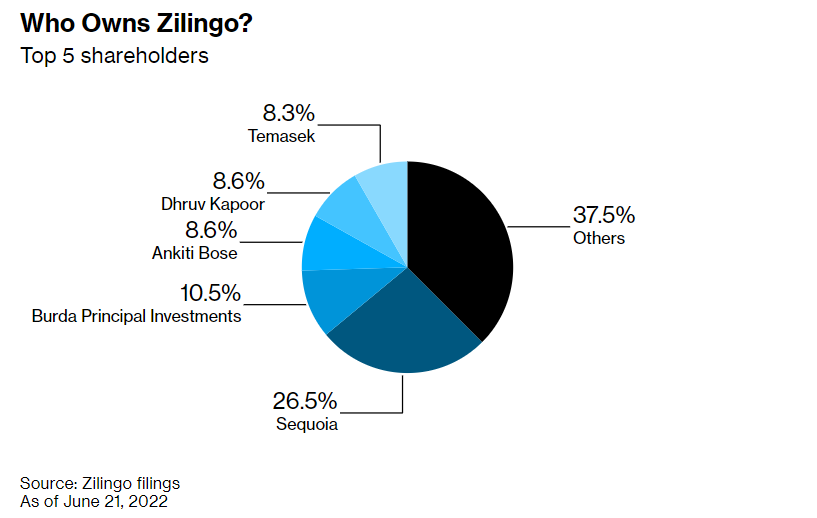

Investors: Sequoia India, Temasek (Singapore’s sovereign wealth fund), Burda Principal Investments, and plenty of others.

The Business Model and its Flaws:

Like many startups. Zilingo often pivoted. Unlike others, they were probably a bit too bold and eager to enter new markets. Zilingo was originally set up as a platform for small merchants to sell to consumers across Southeast Asia. By late 2017, they decided to reposition into a business-to-business platform, where small manufacturers and wholesalers could sell goods directly to small retailers in the region. From Zilingo’s own site:

Zilingo is a B2B technology platform that powers the global apparel supply chain with innovative solutions for production, sourcing and trade. Over the years, it has evolved into an end-to-end enabler that gives raw material suppliers, fabric mills, manufacturers, wholesalers, distributors, brands and retailers access to commerce, software and services that optimize processes at scale, create cost efficiencies and support sustainable growth.

In 2018, Bose came up with the idea of giving out loans to suppliers and vendors who needed capital. Often getting aggressive giving out capital. But when the pandemic hit, much of the debt had to be written off. This one is more a stroke of bad luck than anything, as from what I’ve read, the initiative was doing pretty well up until the black swan event of covid. But it do be like that.

In another pivot, in 2020, Bose saw an opportunity to supply PPE, and snagged a deal to provide India with 10 million KN-95 masks, valued at $22.5 million. Six months later, Zilingo is in a legal battle with the Indian government, who claims the company failed to deliver over three million masks on time. The lawsuit is still ongoing.

Up here on my high horse, it’s easy to be critical. I’ve never built a business, so take everything I say with a grain of salt. But most people would agree that chopping and changing business models, depending on the flavour of the month, is not a great strategy. But at the same time, you need to experiment as a startup to see what works. My belief is that the problem was that Zilingo went way too big and fast, into untried and untested waters. Actions no doubt fueled by the wads of VC money they were given. So I don’t blame Zilingo. I do blame them for all the shady shit that’s about to be shown. Let me give you a rundown.

Timeline:

December 2014: Ankiti Bose, then just 23 years old, meets Dhruv Kapoor at a house party in Indian tech capital Bengaluru.

Both realise they have complementary skills and similar ambitions to build their own start-up. Four months later they quit their jobs, and each put in $30,000 to found Zilingo.

2018: Zilingo raises $54 million from investors. They decide to splurge $1 million to fly nine influencers out to Morocco for a three-day extravaganza. You can watch Zach King’s video about it here. This marketing exercise was apparently a massive flop. *shocked Pikachu face*

February 2019: Zilingo raises US$226 million at a valuation of US$970 million. Ankiti Bose is just 27 years old.

October 2019: Zilingo announces it will spend US$100 million to expand into the US, establishing offices in New York and Los Angeles. Bose’s idea is to take advantage of Trump’s trade war by offering American retailers a way to avoid tariffs by finding producers outside China. Less than a year later, the company shuts down its US operations.

November 2020: Zilingo apparently has barely enough cash to last a month. A group of existing investors including Sequoia, EDBI, Sofina, Temasek and SIG stepped in to rescue the company by purchasing US$25 million of convertible notes.2

January 2021: Shailendra Singh, a longtime supporter of Bose and head of Sequoia India, suggests Bose consider stepping aside. Mentions that Ananth Narayanan, founder of Mensa Brands and ex-CEO of fashion platform Myntra, could be a potential successor. Bose is not happy understandably.

July 2021: Zilingo takes on mezzanine debt of US$40 million from Indies Capital Partners and Varde Partners, with subsequent efforts to raise money from private equity and venture capital firms failing.

March 31, 2022: Bose is suspended from her duties as Zilingo opens an investigation into allegations of accounting irregularities.

May 2022: CFO Ramesh Bafna quits after only joining Zilingo in March.

May 20, 2022: CEO Ankiti Bose is fired.

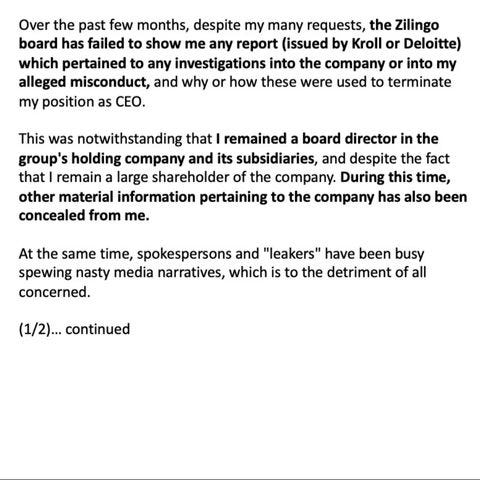

June 30, 2022: Bose resigns from Zilingo’s board, apparently due to a lack of access to information. Bose said the board failed to show her investigation reports on her alleged misconduct.3

Zilingo directors including Sequoia India MD Shailendra Singh, Temasek’s Shane Xu, Burda’s Albert Shyy and GoTo CEO Andre Soelistyo resign from the board.

Co-founder Dhruv Kapoor proposes a management buyout to the company’s board.4

August 2022: After seven years with Zilingo, Chief Operating Officer Aadi Vaidya quits. The 19 remaining staff in the Philippines are also reportedly laid off. At one point staff in the Philippines was 30-40 people.

Whacky World

For me, this story has some all-time-worthy wack shit shenanigans going on. And this seems to be ok?

In Bloomberg’s piece, How a Celebrity CEO’s Rule of Fear Helped Bring Down Hot Startup Zilingo, they mention:

“Zilingo's turmoil highlights an apparent lax internal corporate governance culture that's not uncommon in the startup industry. For two years, the company failed to file annual financial statements, a basic requirement for all businesses of its size in Singapore.”

Am I taking crazy pills? In what world is this acceptable as an investor? I would be spitting chips if I was an investor, having put money in and receiving no audited financial updates. And maybe, just maybe, if you got me in a fucking ripper mood, I might sit on my hands and do nothing. But no! Temasek and EDBI chose the third of two options and decided to plough more money in late 2020. How does that conversation even go? “Ah yes in the absence of financial information, we have decided to give you even more money”. A fool and his money are soon parted.

Are investors that desperate and hungry for growth that pissing money into the wind is a legitimate strategy? My expectations of venture investors are low and holy shit were they met. And Bose’s attitude to financial reporting reeks to high heavens:

Bose said in an interview with Bloomberg News in May that Zilingo has used aggressive methods for recognizing revenue, but that the calculations are standard practice for the industry and that all of its investors were fully aware of them. “These matters are well understood by all investors,”

Ok. Cool. Cool. Cool. What I feel like I just read is “Sure, maybe we fluff the numbers a little bit. But so does everyone else! And investors understand that!”. I legit give up ¯\_(ツ)_/¯

But since all these juicy details are coming out, I’m guessing there is one insider more than happy to sling shit and I am all here for it:

In one instance, Bose messaged a senior lieutenant early on a Sunday morning and called about a dozen times. When the employee didn’t pick up immediately, she told the lieutenant: “You obviously don’t care about the company enough.”

“She allegedly told some staff they’d have no second chance in the startup industry because of her powerful connections. She would publicly shame employees and declare that she had to do everything herself to save the company, one person said. Another described her as a narcissist who would throw anyone under the bus if it meant saving her own reputation.”

And this quote5 from Bose got me good. I can only imagine what a sports coach would feel reading this. For me, it’s legit the definition of a good leader lmao:

When something is wrong the blame falls on me, but everyone’s there to take credit for the good.

And what did we learn?

Be cautious of the charming CEO founder

Why does this keep happening? Theranos, WeWork, and Zenefits are all perfect examples where you have a charismatic yet young founder with a board asleep at the wheel. The CEOs deserve to be flamed. But investors also enable them. Reminds of rich bratty children. If you give them everything they ever want, and never question them or pull them up when they step out of line, of course, there’s gonna be problems.

Safety is not in numbers

I’ll always remember Howard Marks’ saying “If you behave the same as everyone else, you’ll achieve the same as everyone else”. And as my mum told me after I followed my friends into idiotic endeavours “If all your mates jumped off a cliff, would you?”. The same applies to investing. Just because all your super cool venture investing buddies are jumping on this new hot homegrown tech company, doesn’t mean you have to as well!

As I mentioned in the TL;DR, two investors mentioned to Bloomberg that they decided not to back Zilingo after they found evidence of merchant fraud in Indonesia! I legit can’t find any further information on this. I’d love to find out how they knew fraud was rampant in Indonesia. But if they knew it, why didn’t others? This leaves us with two options. Either:

A) Investors like Temasek and Sequoia India’s due diligence absolutely sucks if they missed that critical piece of information, or:

B) They knowingly saw fraud and decided to look the other way in the hope that everything worked itself out. I don’t know which answer I prefer.

But, I understand the dilemma here though. Imagine being the analyst questioning irregularities and creating issues when other companies are becoming unicorns overnight. Colleagues would assume you're just getting in the way of the gravy train. And that is not a way to win any friends on the board, on management teams, or to progress your career. You might even lose your job for that. But you never lose your job investing in a steaming turd, as long as you did it in the safety of a crowd!

So what happens now?

Not a crazy call as it’s more a consensus view at this point, but Zilingo may very well be a sign of things to come over the next couple of years. Media darling “tech” companies at exorbitant valuations coming crashing back down to earth. Celebrity CEOs may or may not be included.

But who are the losers in this situation? Well, kind of everyone. Investors have pretty much got a dud on their books. But they’ll survive. Zilingo senior leadership don’t come out looking great, but they’ll be ok. Like usual it’s the common folk who get screwed. The employees who relied on Zilingo for a wage, maybe hoping for stock options to vest for all their hard work. If anyone comes out ok, I hope it’s them.

When Ankiti Bose was asked in an interview on Zilingo’s website6 what mantra she swears by in her professional and personal life?

The strongest steel is forged by the hottest fire.

Let’s hope so.

You can find previous posts here. I also interview legends at Compounding Curiosity, lurk on Twitter @scarrottkalani, and have a Discord server for everything Allocators Asia (I’d love for you to join our cool little community we got going).

Want to get in contact? Reply to this email, comment on Substack, or send a letter via carrier pigeon and trust that fate will deliver it.

lucky this didn't happen in the US. for sure there would be a justice department case regarding wire fraud