Buffett’s Big Bet on Apple

Understanding the investment into the consumer tech giant

Special thanks to Jon from Asianometry for the inspiration, motivation, and help to put this post together.

In the first quarter of 2016, Berkshire Hathaway purchased 9.8 million shares of Apple Inc for the first time at around $109 a share.

The next quarter, Buffett revealed his investment to the world and by then it had already dropped in value from $1.1 billion to about $888 million. He had already lost $220 million.

In April of that same year, legendary hedge fund investor Carl Icahn announced he had sold all of the 45 million shares he had at the end of the year. So what was Buffett thinking?

The media could smell blood. Was an investment legend starting to falter and resorting to tech investing to save him? What was his investment angle?

Yet fast forward to today and you could snarkily say that on a dollar amount returned, Buffett's big bet on Apple has made him the greatest tech investor of all time. But there may be a grain of truth to this initial outlandish statement.

Since Berkshire’s initial investment, Apple’s value has more than tripled from ~$700B to $2.4 T. Berkshire’s stake in the Tech giant is now worth $122B for an unrealized gain of over $80B. Apple’s recent quarterly dividend from Apple gave them a cool $200m+ alone.

So this is a case study into Berkshire’s big Apple bet, and how he and his new Berkshire buddies were able to do it…

Coca-Cola

To understand the Apple investment, you need to understand one of Buffett’s OG investments. The time-tested, and easily understandable investment in Coca-Cola back in the ‘80s is a value-investing favourite.

Why? What’s so special about this beverage bet?

Buffett began buying shares of Coke through Berkshire Hathaway in 1988 and now owns more than 400 million shares, just under a 10% stake of the entire beverage giant, and is their largest shareholder today.

So why does Buffett’s investment in Coca-Cola so well-known and loved? Because it’s easy to understand. Coke possessed an incredibly strong brand paired with intelligent asset allocation, combined with a fair valuation and Buffett’s long-term time horizon. A solid recipe for success.

It’s a story every value investor knows and loves to draw upon when claiming their own investments are fairly valued and have a strong moat-like Coke.

Yet Buffett’s greatest-yet-most-underrated investment would be in a sector he was famously out of touch with and lacking interest in, technology.

The Setup

Buffett is not a tech nerd. I can’t stress this enough. His work office has a landline phone, no computer, and throughout his entire life of 92 years on this earth, he’s apparently only sent one solitary email, to Jeff Raikes of Microsoft1.

In his 1997 letter to shareholders on the topic of low enthusiasm from shareholders about Berkshire’s ‘fancy’ new website, Warren remarked: “being a life-long sufferer from technophobia, I can empathize with this group.”

So I think it should be clear from this point that investing in Apple was not a Warren Buffett-driven endeavour. And to understand the Apple investment, you need to understand a couple of Warren’s understudies.

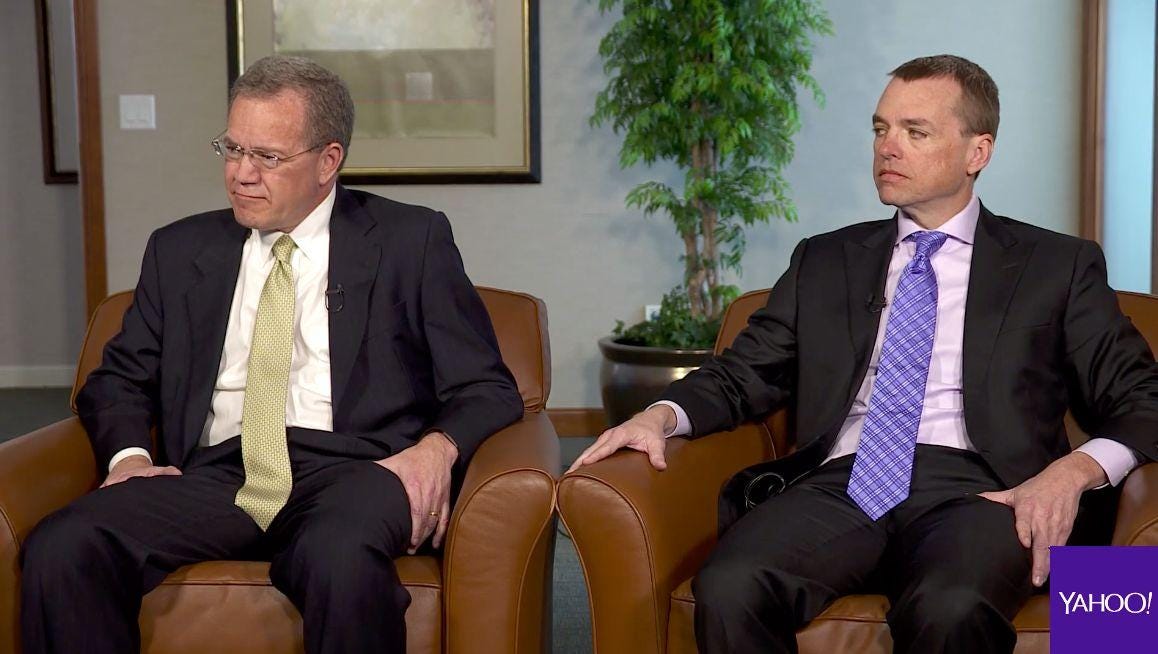

Let me introduce Todd Combs and Ted Weschler.

Todd Combs is a former hedge fund manager who joined Berkshire on the back of cold calling Warren’s right-hand man charlie Munger, meeting charlie at breakfast and chatting for hours, before being introduced to Buffett where they also hit it off. During their extended conversations, Buffett began talking about his plan to hire a money manager. Combs — who even admits this is true — started thinking about another person he could recommend. Before Buffett dropped, ‘Well, I think we’re kind of thinking of you.’ Thus cementing the unlikely fairytale career journey for Combs.

Ted Weschler is also a former hedge fund manager now managing money at Berkshire and arrived in a similarly strange way.

Ted Weschler first met Warren Buffett over dinner. A rather expensive one at that. Through a charity auction, Weschler had made the winning bid for a bite with Buffett.

“I was expecting a stiff hour or so meeting, and it ended up being this long visit at the office and a terrific dinner,"

Not quite full, the following year, the madman did it again, bidding and winning on a second meeting. All up, both meals cost Weschler more than $US5m. After peppering his new friend Warren with questions, he got one of his own: Would he be interested in coming to work for Berkshire?

And in a bold decision against the oracle of Omaha, Weschler initially rejected Warren’s offer to work at Berkshire, electing to stay in Charlottesville due to family and work. But three years later, he sent a careful letter interested in that prior offer and received a response that Warren would be happy to have him and he can manage money from the moon as far as he was concerned.

And this is how Todd and Tedd became assets of Berkshire and Buffett.

Buffett speaks of both highly2, “They're both absolutely terrific. [...] They are assets of Berkshire.”

And between Ted and Todd at the end of 2021, they were managing $34b of Berkshire’s investments between them.

But where does the interest in an Apple investment begin?

Getting Buffett on board the Apple investment was in part thanks to Combs.

The story goes that Combs would often visit Buffett’s house on many a Saturdays to talk, and there is a litmus test they frequently use. Warren will ask

“How many names in the S&P are going to be 15x earnings in the next 12 months? How many are going to earn more in five years (using a 90% confidence interval), and how many will compound at 7% (using a 50% confidence interval)?”

In this exercise, you are solving for cyclicality, compounding, and the initial price of an investment. Combs said that this rubric was used to find Apple, since at the time the same 3-5 names kept coming up.

And the business case for Apple was explained by Ted Weschler in October 2016 in an interview with a German business magazine, Ted mentions that he considers the iPhone to be more effective than Coca-Cola at creating a loyal customer base. And that once people bought an iPhone, they seldom switched because they didn't want to have to learn a new operating system.

“Once you are fully invested in the App ecosystem and you have got your thousands of photographs up in the cloud and you are used to the keystrokes and functionality and where everything is, you become a sticky consumer.”

Weschler had recognized that Tim Cook was taking the ecosystem that Jobs had created and wringing more revenue out of it, turning the iPhone into a subscription-based business that would generate cash for years to come.

The Payoff

So there comes a time to take the leap, put your money where your mouth is, and invest in your thesis.

But it’s unknown exactly whether it was Combs or Weschler who initiated Berkshire’s Apple investment. But by the end of 2018, this initial one billion dollar bet by Berkshire had turned into 255m shares, at a cost of $36B.

Fair to say that Buffett had bought into Ted and Todd’s vision and valuation of Apple.

"Apple has an extraordinary consumer franchise, I see how strong that ecosystem is, to an extraordinary degree. You are very, very, very locked in, at least psychologically and mentally, to the product you are using. [iPhone] is a very sticky product.”

No doubt able to see how strong their ecosystem thanks to two very handy proteges.

By 2018, Berkshire’s Apple position was its second-biggest public holding, only behind Wells Fargo (which has since been sold off). And there were no other tech companies in Berkshire Hathaway's top 15 holdings by value.

Today, Berkshire’s Apple investment now accounts for over 40% of their total public portfolio! Unsurprisingly, their largest public holding. At the end of 2021, only Berkshire’s insurance division was a larger portion of their overall business.

And Berkshire still isn’t done with Apple, having bought an additional 3.9 million shares of Apple in Q2 2022. Bringing their total investment to just under 900m shares at over $120B at the time of writing.

But what are the actual eye-watering monetary returns on this Apple investment I hear you ask?

Overall, Apple’s value has more than tripled from ~$700B to $2.4T and Berkshire’s stake in the Tech giant is now worth $122B for an unrealized gain of over $80B. Apple’s recent quarterly dividend from Apple gave them a cool $200m+ alone.

Berkshire’s Apple investment, whilst not as crazy when compared to the VC investments of Naspers/Prosus’s $34 million investment into Tencent in 2001 or Masayoshi Son’s and Softbank's $20m investment into Alibaba. It does hold a candle in terms of total $ returned and already being a public company.

For an 86-year-old technophobe [at the time of original investment], who most would write off as having his best years behind him, Buffett has arguably saved his best for last with this Apple investment.

Lesson here?

Buffett’s Coca-Cola investment story has always been the stuff of legends. But that investment parable has been surpassed. Bill Smead, chief investment officer at Smead Capital Management, "Buffett is having his Coca-Cola moment on Apple." Which mind you, this is being done on a much larger dollar scale!

It’s probably fair to say Buffett’s Apple investment is the greatest public market tech investment ever made.

My takeaway? Surround yourself with curious people. You never know what may eventuate.

So just as Dewey from Malcolm in the Middle wisely said:

And Berkshire's big Apple bet has shown that.

You can find my previous posts here. I also interview legends at Compounding Curiosity, lurk on Twitter @scarrottkalani, and have a Discord server for everything Allocators Asia (I’d love for you to join our cool little community we got going).

Want to get in contact? Reply to this email, comment on Substack, or send a letter via carrier pigeon and trust that fate will deliver it.