"The past makes you wanna die out of regret and the future makes for depressed out of anxiety. So, by process of elimination, the present is likely the happiest time."

- Hikigaya Hachiman

One of those months where I blinked and missed it. Some bloody good content within here, hopefully, you enjoy it as much as I did.

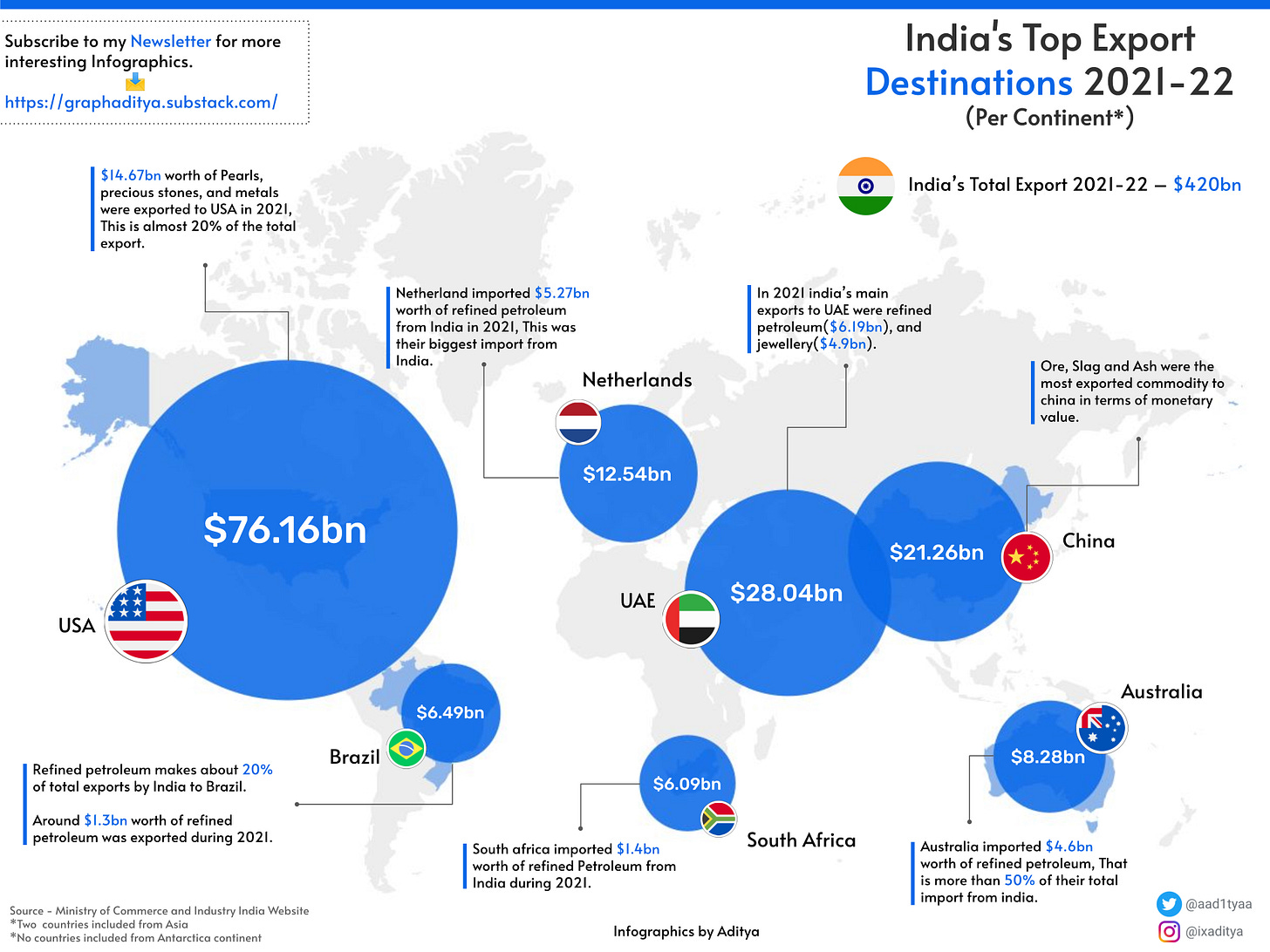

CHART OF THE MONTH:

READ:

Legoland Korea Is Wrecking South Korea’s Bond Market

Absolute bonkers headline. Essentially a story of financial contagion. Because a local government built an unprofitable Legoland and said local government threatened not to repay the loans, the entire Korean municipal and corporate bond market is now at risk.

the fallout is not limited to local government bonds; it impacts the whole of South Korea’s bond market, worth more than $2 trillion. Corporate bonds are considered less safe than local government bonds. If few buyers are brave enough to buy local government bonds under these conditions, even fewer buyers can muster enough courage to buy corporate bonds. One of the safest corporate bonds in South Korea is issued by Korea Electric Power Corp. (KEPCO). The returns for KEPCO’s three-year bond had climbed from 2.184 percent to 5.825 percent since the beginning of this year. But in its latest issuance, the KEPCO three-year bond worth 200 billion won (about $146 million) could not find a buyer.

and,

To prevent the credit market from seizing up completely, the South Korean government stepped in by providing a liquidity facility of more than 50 trillion won (about $35 billion). The Bank of Korea also injected 42.5 trillion won (about $31 billion) to stabilize the short-term bond market, and South Korea’s five largest banks also pledged to provide up to 95 trillion won (about $67 billion) in liquidity. There is an absurdist quality to these measures: On the one hand, the Bank of Korea has been aggressively raising the benchmark interest rate to curb inflation by reducing liquidity, but on the other hand, the South Korean government is injecting liquidity to the market to stave off a total economic collapse.

China's Secret Reason for Electrification

Love this article. Doesn’t mess around. Gets straight to it:

China is electrifying its economy at breakneck speed. But the way it does it makes little sense if carbon emissions were the reason.

So why are they doing it?

Because they are busy making China more resilient to THE geopolitical threat that could bring the country to its knees.

China’s leaders are (rightly so) obsessed with the threat of a blockade. How would a blockade manifest first? By cutting China off the energy supplies from overseas.

Instantly, the flow of 10 million oil barrels per day would stop. So would the 15 billion cubic feet of gas per day. And the 250 million tons per year of coal. […]

There is, and will not be for at least 20 years, no valid alternative to fossil fuel to run a military force efficiently. Electric buses are possible, electric tanks are just not an option.

So in the case of war + blockade, you would need to save ALL the local gas & oil production for the war effort (military + industrial production of weapons).

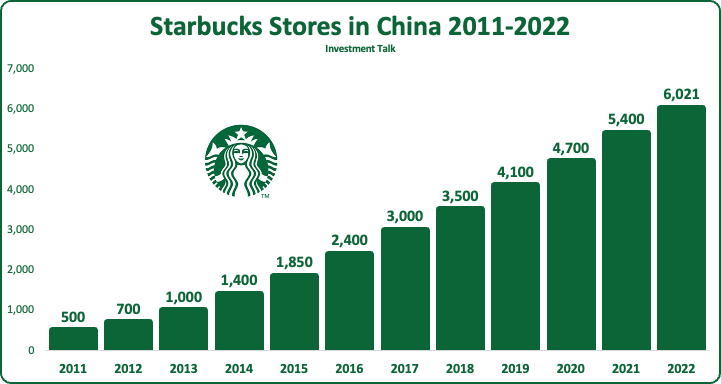

Starbucks pins their recovery on a strong domestic consumer and a China recovery

Excellent coverage of Starbucks’ China presence.

Starbucks is quite particular about which markets they like to run company-operated stores in, and in China every store is company-operated. This is in contrast to Starbucks’ licensing model, where the operating margins are higher (licensed stores are responsible for OpEx & CapEx) but the revenues (mainly royalties and margin on branded products) are smaller.

Despite making up 49% of the global store count, licensed stores bring in just 11% of Starbucks’ revenues. Licensing tends to carry less immediate risk and offers a capital-light method of rapid expansion.

Out of the 83 countries where you can find a Starbucks, just 8 have company-operated operated stores. Of those 8 markets (home to 18,250 stores), China accounts for 33% of the total; up from 23% just four years ago and is second only to the US (51%) and lightyears ahead of the third largest company-operated market, Japan (9%).

Standing at 6,021 stores (as of Q4 2022), Starbucks has expanded their presence in China at a compounded annual rate of 25% over the last eleven years.

Further recommended reading:

Zhang Yiming’s Last Speech [Part 1 & Part 2] - “The most basic thing is to realize that everyone, including yourself, is an ordinary person. Some media want to add drama when they report on startups and people's stories, either by making the experience seem legendary or by dramatizing people’s characters. […] most things, in my opinion, have reasons and justifications. Nothing is particularly that difficult or unusual to explain. […] if you keep an ordinary mind, accept yourself as you are, and do well for yourself, you can often do things well.”

Scaling a European medtech start-up in Asia - “for up-and-coming surgical robotics companies in Europe with dreams of Asian expansion, proper research on what local governments are doing and coordinating carefully with local partners on the ground will be essential.”

China's zero-COVID policy is dead - “No longer are local governments judged favourably if they implement strict lockdowns as Shanghai did in March 2022. Today, local government officials will be penalised if they take things too far. In practice, this means a sequential loosening of the COVID-19 control policy.”

Furusato Nōzei: Get Local Gifts & Tax Breaks by Donating to Japanese Small-Towns - This is such a sick initiative. Because rural-to-urban migration is growing, fewer working citizens are paying taxes in their hometowns, leaving municipalities with little funds. So there’s now a tax program where people in cities can donate to independent producers in the countryside in exchange for a credit on their income and resident taxes. For this “donation”, you can get anything from premium meat and cheese to pottery and other artisanal goods from just about anywhere in Japan.

LISTEN:

Rob Sheridan of Uluwatu Limited, a Hong Kong-based investment manager on Longriver podcast [Spotify] [Apple]

Rob’s story is an interesting one, but there’s also some sage investment advice here. Talking about his investment process, the art of portfolio construction, and finishes off by discussing a Japanese ERP software provider. What’s not to love!?

Pacheco Pardo, Shrimp to Whale: South Korea from the Forgotten War to K-Pop [Spotify] [Apple]

Ramon is the author of Shrimp to Whale, which is easily one of my favourite books this year. Also a genuinely nice guy. Interesting point I took away was that chaebols1, for all their criticism, have played a key role in South Korea’s growth:

“of course there was corruption, and some felt that the government was telling them basically what to do, at least until the 1980s. but they had upsides as well, which was you had these very big companies that were able to receive the capital from the state, but then they were able to become internationally competitive. And if they had been small-medium size enterprises, it might be me, have been very difficult to scale up sufficiently to be able to export”

TSMC and Taiwan’s Semiconductor Industry with Tim Koay, Historian on Taiwan Early Stage Semiconductor Initiative [Spotify] [Apple]

Absolute banger of a podcast on Taiwan’s Semiconductor Industry origins. Next level good. There’s a funny tale about when how in TSMC’s early days, companies that had to invest were so bearish on the companies future, that stock certificates were thrown out or filed away assuming they possessed little value, only to be found years later. A smidge better than finding old lunch money I reckon!

Value Punks, Global Value Investing [Spotify] [Apple]

My interview with a coupla good mates! Balkar and Daye talk about value investing and what it means, and the case for investing in international markets.

We don’t think there are any hard truths out there in investing. And maybe that’s lost on some people because value investing seems to have increasingly become like a dogmatic field.

Just look at how many accounts there are on Twitter that do nothing other than quote Ben Graham and Charlie Munger, Buffett and all that, right? So like people think you just follow these timeless principles and you can do okay.

What’s interesting though is that when you look at the reality, right? And what you tend to see is that so many investors lose money and get hurt by being so dogmatic with these principles.

WATCH:

I need to highlight the above video. “Neon Taipei, a Dying Beauty”, is a deep dive into Neon's history from its discovery, to its commercialization, use in film and video games and its current downfall. Rice Noodles’ storytelling, editing, and attention to detail are legit phenomenal. One of the best things I’ve seen on YouTube this year.

But as usual, for all my video recommendations, the most efficient way is through a YouTube playlist. I highlight both popular videos and undiscovered gems. But mostly, I want to showcase some of the most insightful and interesting videos related to Asia-Pacific for November.

BOOKS:

[READ] A New Idea of India by Rajeev Mantri and Harsh Madhusudan

Admittedly, I am a (regretful yet improving) noob on the topic of India. So this book was a steep learning curve, but well worth it.

India's economy should boom not so that Indians can feel superior, but because it is reasonable to want the average Indian to be at least as well off as the average human. But for that India will have to make prosperity, and not merely the removal of poverty, the overarching aim. Indian society will be free and open when it focuses on self-improvement as our mantra. Indians should take responsibility for their destiny, channelise their energies towards preparing to win, and as Krishna advised Arjuna, do so without worrying about the outcome

Keep an eye out for Rajeev’s appearance on my podcast later this month!

Gearing up to be a big last month of 2022. Lots of podcast episodes being recorded. Lots to look forward too. My favourite time of year!

Lastly, I did my first ever interview. Gotta admit, took a little getting used answering questions rather than asking them! But John asked some incredibly thoughtful questions, yet kept it conversational which I thoroughly enjoyed.

So if you want to understand better who I am, what I do, and why I do it, worth a gander :)

You can find previous posts here. I also interview legends at Compounding Curiosity, lurk on Twitter @scarrottkalani, and have a Discord server for everything Allocators Asia (I’d love for you to join our cool little community we got going).

Want to get in contact? Leave anonymous feedback, comment on Substack, or send a letter via carrier pigeon and trust that fate will deliver it.

in case you haven’t heard the term before: “A chaebol is a large industrial South Korean conglomerate run and controlled by an individual or family. A chaebol often consists of multiple diversified affiliates, controlled by a person or group whose power over the group often exceeds legal authority. - Wikipedia”