"Stand up! Be bold! Be strong!

Take the whole responsibility on your own shoulders, and know that you are the creator of your own destiny all the strength and success you want is within yourself.

Therefore make your own future”

- Swami Vivekananda

Short and sharp issue today. Let’s go.

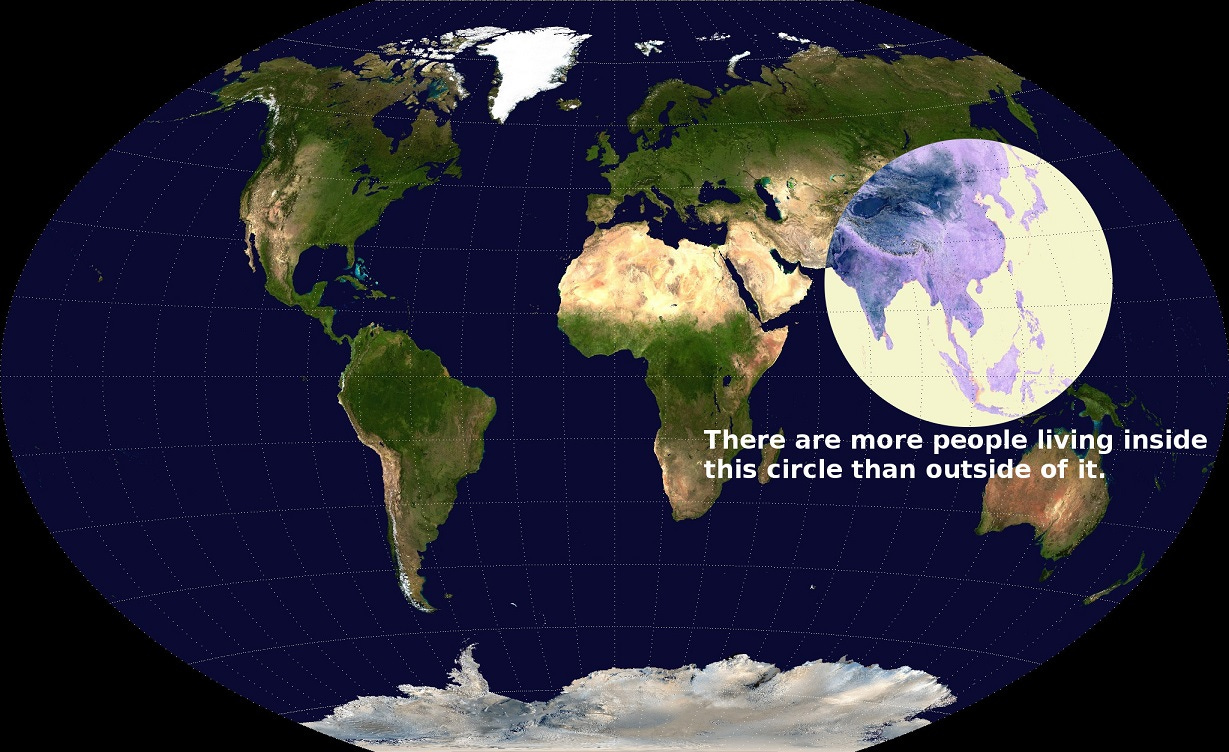

Chart of the Month - Population Circle

The Epic Tale of Japan's Mightiest Companies: The Sogo Shosha

Rei again bringing the goods. The Sogo Shosha are a fascinating example of Japan's economic history. They're a reminder of the country's rise as an economic superpower, yet they're also a symbol of the challenges that Japan faces as it tries to adapt to a changing global economy.

the biggest Sogo Shosha are truly a one-stop-shop, handling everything from hardware and software development to construction, farming, factories, retail, medicine, and even government functions, such as laws and infrastructure procurements.

While trading companies can be found around the world, only a few can boast the scale of operations and versatility of a Japanese Sogo Shosha. These giants have a global distribution network and utilize their financial resources to their fullest, with economic sizes that could rival some countries, truly making them a force to be reckoned with.

Naval Warfare, the Crux Of Industrial War

There is also the discussion that China’s navy is a “green sea” navy. It means it is mostly designed for coastal defense, and ill fit for overseas expeditions.

It is entirely true and would be a serious weakness if Chinese ships wanted to, let’s say, blockade the Panama Canal. Or defend Chinese interests in the Atlantic.

However, I doubt this is much of an issue to control the South China Sea…

Especially as this is a shallow sea, where submarines might struggle to make a difference.

So combined with the presence of missiles and air force on the mainland, able to support the Chinese Navy (more on that below), I would say both navies are on relatively equal footing at the moment.

And the balance is quickly tipping in China’s favor.

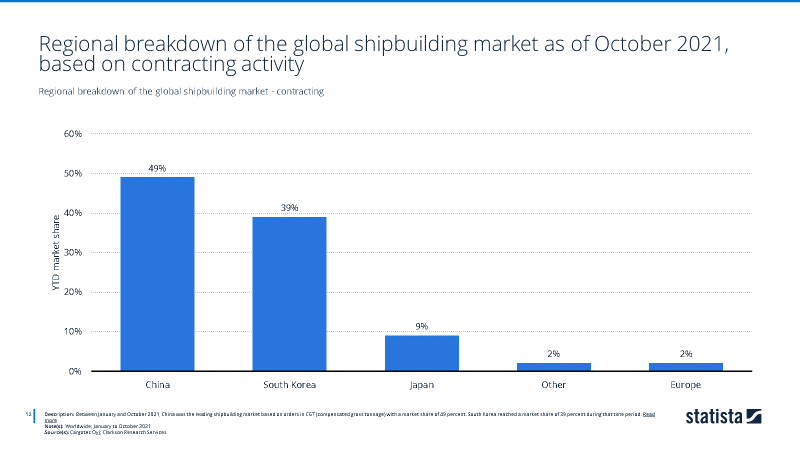

And some interesting (worrying?) stats around shipbuilding:

Ultimately, in case of a USA-China hot war, military shipyard capacity will be relatively irrelevant. WW2 was won by the USA by converting civilian capacity to military one.

Ford & GM car factories —» tank factories.

Civilian shipyards —» military shipyards.

So military shipyards are maybe not THAT important. In case of a serious conflict, the “spare” capacity of the civilian industry would be the real determining factor. […]

The problem for the West is that the ENTIRE shipbuilding industry is now in Asia. I am not exaggerating. Only 4% of the world’s ships are NOT built in Japan, Korea, or China…

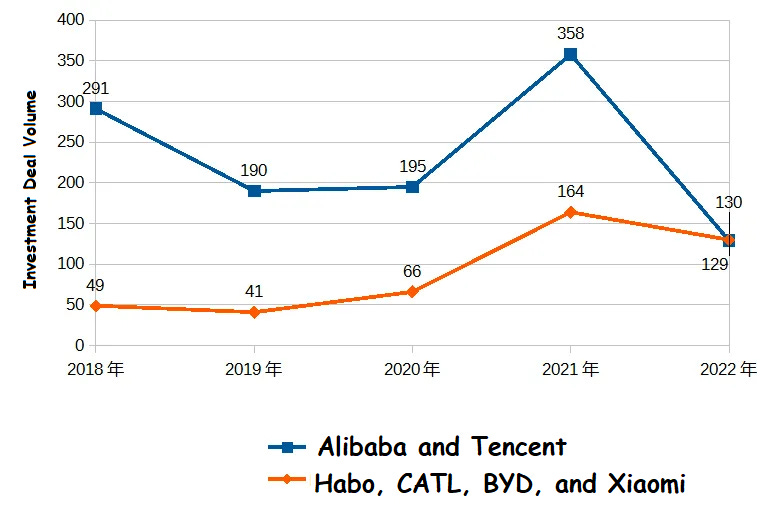

“Hardtech” Corporate VCs Rising in China

A startup’s golden ticket to fame and fortune used to be a check from either Alibaba or Tencent. During China’s Internet boom, you are either on “Team Ali” or “Team Tencent.” With that affiliation comes either the massive platform advantage on Taobao or AliPay that Alibaba offers, or the massive traffic and distribution advantage on WeChat that Tencent offers. […]

Up until 2018, more than 50% of China’s tech unicorns are still either with Team Ali or Team Tencent. With a slowing economy, Covid, tougher antitrust and data regulations, intensifying technology sanctions from the US, and the central government’s broad effort to clean up 40 years of “startup debt” since Opening and Reform […], being in either Alibaba or Tencent’s orbit is not what it used to be, as both giants try to “look smaller.” […]

Alibaba and Tencent’s combined investment deal volume (blue) has fallen to about the same level as the combined volume of Habo, CATL, BYD, and Xiaomi (orange).

China On Track To Pass Japan in Auto Exports

EVs are going to help China do to Japan what Japan did to the US in the 1970s. So Japanese automakers are feeling the pressure from Chinese competition, and for good reason.

But some of the Japanese automakers pain is self inflicted:

when there is a big, abrupt shift in technology and market conditions that undermine the existing business model, the dominant players are likely to stay with the old technology and business model for too long because they underestimate the shift in front of their eyes, That gives room for new challengers to rise.

Japanese firms suffer an additional problem hobbling their ability to adapt to change due to almost exclusive promotion from within the company, executives find it hard to abandon a product or technology championed by the seniors who sponsored them. That would feel like a betrayal. It’s one of the reasons companies like SONY lost billions of dollars over many years by sticking with TVs for far too long. Can new CEO Koji stray very far from the strategy trumpeted by Toyoda?

It is not foreordained that Toyota, Honda, et. al. will fall victim to this common pattern. But time is not on their side.

Here...comes...INDIA!!! - The world has a new largest country, and it's on the move

Home to a large population, a rapidly expanding middle class, a favorable business environment, and well-positioned to benefit from the global shift to a more digital economy. India is poised to become a major economic power in the coming decades.

I admit that I don’t yet know what all the results of India’s rise will be. But I feel that it has to be something to celebrate — not just because it means hundreds of millions of human beings released from desperate poverty, but because it means a richer world. Economically richer, yes, but also culturally richer, politically more multipolar. It will be a world where power and wealth and global mindshare is no longer monopolized by the powers that carved out empires in the 19th century. If the human race is to flourish on this planet, India’s rise had to happen.

Long-term front-running - An introduction to value investing

Michael does a tonne of incredible work with Asian Century Stocks, and this primer is no different. Gonna be a piece I share thick and fast with mates looking to learn more!

Getting to a well-balanced portfolio requires turning over many stones and discarding ideas that didn’t work out. And when you find ideas that score particularly well, be prepared to bet big.

Acquired Podcast: The Death of Japan’s Sega Corporation (1:05 hours) [Spotify] [Apple]

In a single console generation, Sega went from ~0 to 50% US market share (dethroning Nintendo!!), and then kind of just… died? A shorter than normal Acquired episode, but one well worthy of a listen.

I love the story about the disaster that was the Sega Saturn:

the PlayStation will be released in the US on September 9th, 1995. Sega's like, great, they're not moving it up, we're going to beat them to the punch, we're live today, we got a four-month head start, let's go. Then the new head of Sony Computer Entertainment America, Steve Race formerly of Sega of America, up to the podium to give a "brief presentation".

He walks slowly up to the podium. He's got a large stack of notes. He places them down on the lectern, shuffles them around, waits a beat, he's ready to give his big speech. He looks up, he looks at the audience, and he says, $299. Then he picks up his notes, and he walks off stage. Most people in the industry, I think, would agree that this is the greatest moment in all of video game industry history.

Why on earth would any consumer go buy a Sega Saturn today on May 11th, on its launch day, that has no Sonic game, has only six games total, and it costs 399, when you now know that the PlayStation which is far superior, is going to come out just four months later, they're going to have perfect ports of all the latest and greatest arcade technology video games, and it's going to cost less? You're not going to buy a Saturn.

and poor little Sonic

Sonic was a one trick pony, and that they never really found an effective way to expand the franchise. [...] It feels to me like there's a lot of nostalgia to play with, but it didn't really create any durable extensible IP or gameplay, frankly.

Been (a little) busy on the YouTube channel, doing not one but two(!) videos this month!

My latest one was a collab with

from about his post, Samsung is in a crucial transition.From its humble beginnings as a small trading company in postwar South Korea to becoming a global technological powerhouse, Samsung has left a permanent mark on the world of tech.

Join me as I help explain and analyse its incredible origins, iconic products, and relentless pursuit of excellence that defines Samsung's legacy.

My other video this month was another collaboration this time with

from on his post The Cultural Superpowers of 2072.Culturally, America is the most dominant country today. Everyone wants to watch American TV shows, listen to American music and follow American politics.

There are three important things to being culturally dominant: high incomes, a large market and cultural freedom. America has all three, and is unique in having all three at the same time.

But other countries will grow faster and hit all three criteria, they will become culturally dominant. Maybe not in 10 years, maybe in 25, and very likely in 50 years, the market for popular cultural attention is going to be dominated by (currently) developing countries.

But otherwise, my video recommendations are the same as every other month, through a YouTube playlist. I aim to highlight both well-known channels and some hidden gems. But mostly, I just want to showcase some of the most insightful and interesting videos related to Asia-Pacific for this month.

[READ] From Third World to First: The Singapore Story: 1965-2000 by Lee Kuan Yew

I don’t think it’s actually meant to be a "how-to" book, but this is probably the GOAT material on nation-building.

The future is as full of promise as it is fraught with uncertainty. The industrial society is giving way to one based on knowledge. The new divide in the world will be between those with the knowledge and those without. We must learn and be part of the knowledge-based world. That we have succeeded in the last three decades does not ensure our doing so in the future. However, we stand a better chance of not failing if we abide by the basic principles that have helped us progress: social cohesion through sharing the benefits of progress, equal opportunities for all, and meritocracy, with the best man or woman for the job, especially as leaders in government.

Where do dreams go to die? Is it in a cubicle, working 9-5 Mon-Fri?1

I’ve started applying for full-time roles of late2 in finance again, and I'm already feeling like a part of me has died. A wishful part that dreamed of working online, freelancing, or maybe even one day having 1,000 true fans.

I keep trying to remind myself about Tim Urban’s life path tree. Because looking back on when I was a kid, I think what I enjoyed is I really could have done anything or been anyone. A legendary sportsman was possible. Backpacking hippie. Corporate highflyer.

I feel like my potential lifepaths are closing fast. And scariest of all, what if I’m destined to be mid?3

On one hand, I feel young. 27 compared to 77-year-old retiree is blissful. 27 and having no career, no home, no status, no true calling, can be a a little stressful.

If I ‘succeed’ and get a full-time gig, is this it? Is this life?

Go to work for the majority of my weeks, buy a house, pay off mortgage, retire? Where’s the fun?

I like to say variety is the spice of life. So how do I make my life spicy goddammit! Pls help.

I apologise for my whinging and whining. It felt good to write this out.

Overall I’m actually in a good head space. This one teeny-tiny aspect of life just depresses and scares me.

Until next time! 🙃

You can find previous posts here. I also interview legends at Compounding Curiosity, lurk on Twitter @scarrottkalani, and have a Discord server for everything Allocators Asia (I’d love for you to join our cool little community we got going).

Also, a cheeky reminder to subscribe to my YouTube channel! I post videos every time I feel like it and you’ll not only learn a tonne, but be entertained too.

Want to get in contact? Reply to this email, comment on Substack, or send a letter via carrier pigeon and trust that fate will deliver it.

For context, I don't actually look down on others doing 9-5, working Mon-Fri. Everybody gotta make their bread and put food on the table somehow. I won’t bash that. It’s just something that terrifies me personally.

If you’re wondering about my current situation, I started as a casual Lifeguard on a Defense Base as I was finishing my Masters in Finance, finished my degree during COVID then backpacked through Southeast Asia for 6 months, then I returned to lifeguarding lmfao. I really need to get my life together…

for boomers unaware. Mid’s meaning: “Used to insult or degrade an opposing opinion, labeling it as average or poor quality.”

i really liked this collection. this newsletter is a much better use of your time than other "pedestrian" activities imho

That PlayStation story 😂 god I love Acquired