Best of July/Aug in Asia-Pacific

Curating the best content in the region

"At critical moments in time, you can raise the aspirations of other people significantly, especially when they are relatively young, simply by suggesting they do something better or more ambitious than what they might have in mind”

- Tyler Cowen

The quote is something that hits close to home for me. I’ve had a few overwhelming responses to this newsletter over the years that I’ve now printed out and put under my desktop.

It’s amazing how something so small can affect people’s life trajectories so greatly.

Let’s learn!

Kopi Kenangan, the Shein of Coffee - “The coffee chain that's brewing up a storm.”

Last time I was in Singapore I was lucky enough to meet Louis who writes Math Not Magic, and boy is he onto something!

Kopi Kenangan is playing a different game. Instead of selling one product to a wide audience, they are focused on selling a wide variety of products to one audience: Indonesians. There’s no dogma as to what product they sell, or how they distribute it, so long as it remains profitable. If coffee and food products don’t have high margins, they’ll make up for it in volume.

So far, it’s looking promising. In FMCG, there are three things that really matter: selecting the right product, marketing it, and then distributing it. Kopi Kenangan has proven itself up to the first two tasks, but it’s not clear if it can handle the latter. Tirtanata and Prananto seem to have recognised this however; their selection of investors and strategic partners suggests that they are likely to get some help on this front.

Women in India: how to get excited by slow progress

Just an interesting perspective on something I literally have zero knowledge about.

Regardless of the end goal in terms of education or employment, the key point Sahana made was that it’s all about agency, being in control of your own destiny. […] Autonomy gives you a seat at the table. Having an independent income can also help to circumvent being encased in traditional systems.

While it is a tragedy this is necessary, many mothers will build savings independent from the family budget in order to support their own daughter’s education. This sort of action can help ‘break the cycle’. Gold is a typical savings vehicle, with many companies offering borrowing against these assets to help women support the cost of education.

China’s Japanification [Archived Article]

China’s housing market correction since 2021 is not only cyclical (or policy-induced), it is also structural reflecting major changes in demand vs. supply in the housing market. This is similar to Japan’s housing market correction in the 1990s.

Second is similarity in financial imbalance, i.e. the pace of increase and level of debt problem. According to the BIS, China’s total non-financial credit/GDP ratio approached 297% of GDP by end-2022, similar to Japan in the 1990s. Also similarly, debt is mainly domestic and domestic saving rate is high in both countries.

The problem of population aging is also similar. The share of aged population (65 and above) was 12.7% in 1991 in Japan, similar to China in 2019 (12.6%).

But it ain’t all bad news in China,

China has a much larger domestic market, a larger pool of STEM graduates and comprehensive manufacturing sectors. While China may be facing a more challenging external environment than Japan in the 1990s, there is also hope that China can achieve technology upgrade and commercialization in some areas. For instance, China has become a leading player in new energy and new energy vehicles in recent years.

Massive h/t to Emerging Market Skeptic for getting me onto this one!

The Rise & Fall of Foreign Direct Investment in China

From 2000 to 2015 China received about 40% of all net foreign direct investment (FDI) to Emerging Markets (EM). In the wake of the pandemic net FDI flows to China initially surged, but over the last four quarters have turned negative.

In contrast to 2016, the latest decline in net FDI flows has been driven by a sharp decline in foreign investment in China rather than a surge in outbound investment by China. At face value this suggests that ‘de-risking’ of supply chains and diversification through ‘near-/friend-shoring’ may be underway.

But the data is more nuanced and less conclusive: The primary driver of lower foreign direct investment inflows appears to be the repatriation (instead of reinvestment) of foreign multinational’s (MNCs) earnings on their Chinese operations rather than a decline in “greenfield” investments.

Sea - Limited, it seems

Farrer Wealth Advisors with some great insight here around the hottest stock (if only by people’s interest lol) in Southeast Asia at the moment:

Shopee (and Sea’s management) was lambasted for being overly aggressive during 2020-2021 and launching in several markets in LATAM, India, and Europe. The overreach did bite them in the behind and they had to retreat. But for whatever reason, the market seems to think that TikTok employing almost the exact same strategy will be successful. If we’re being intellectually honest, we must admit that TikTok will also likely mess up along the way and retreat from markets where the battle is tougher (or less lucrative).

Related: Hayden Capital’s Letter mentioning Sea Ltd (starts p. 14)

A return to the loss-making days was not what investors wanted to hear. But also did the market really expect the company to remain in “cash-harvesting” mode, when regional ecommerce penetration is still low (~15% on official retail data, and even lower when including informal transactions) and the company still has a lot left to build in its ecosystem’s infrastructure (i.e., self-owned logistics)?

At the heart of it, the market is worried that this recent pivot is primarily a defensive move, in reaction to TikTok’s regional ascent this year. The fear is that Shopee is going to spend all its profits, just to stand still. Perhaps this increased investment is structural (i.e., recurring), something perpetually required to keep competitors at bay. If so, this decreases the long-term margin expectations for the business.

Related: SEA Ltd: The Prodigal Son (2Q deep-dive)

Highly recommend checking out Aaron Pek’s other articles on Sea Ltd as well.

I cannot understand why markets would punish SEA’s share price so severely just because they announced a return to a growth focus [...] Their previously deteriorating businesses are fully healed from a financial perspective, and each of their business units are in much better shape in comparison.

On top of that, SEA has a fortress balance sheet to weather come what may, and their industry’s TAM growth prospects of 10% are as bright as can be realistically hoped for. Going concern risk is practically nil; and they have a dominant 30-50% market share in a commoditized e-commerce industry where competition ultimately boils down to having the greatest economies of scale.

I’m sure I’m missing a lot of negatives since this is primarily a financial statement analysis — but I’m equally sure that I’m missing a lot of positives as well. When your margin of safety is this huge, does it not justify a 12.5x earnings multiple?

Related: Smartkarma’s eBook with 33 Insights published over a 3-year Period by Independent Analyst Oshadhi Kumarasiri who went against the tide with his Bearish Call on SEA LTD.

Luckin overtakes Starbucks in China sales for first time — thanks to ‘pseudo’ coffee

To the surprise of absolutely no one, consumers freaking love sugar syrup with a hit of caffeine:

For self-claimed coffee enthusiasts in China, there’s also room for debate over whether what they like to consume is truly coffee, Ma said, noting that popular coffee items at Chinese Luckin and Starbucks stores should be better described as “sugary mixed drinks with some coffee.”

Citing industry insiders, Ma pointed out that in the second half of 2022, coffee-based drinks only accounted for 60 percent of sales for Luckin. Of those, “five drinks made up for about 75 percent of the revenues, and four out of five are mixed drinks,” like coconut coffee, the chain’s flagship beverage.

“These drinks are all sugary and caffeinated,” Ma said. “While direct black coffee consumption isn’t very high, there is clearly a high preference for caffeine.”

Taxi drivers are earning more from viral TikToks than from rides

Just cool to see some people getting some success in the content game!

Mpo Bhabay, a full-time motorcycle taxi driver for the ride-hailing giant Gojek, amassed 250,000 followers with her high-spirited TikTok videos. In them, the 44-year-old shares stories about her everyday life — from the difficulties of working as a driver to life as a woman and mother in Indonesian society.

In the span of three years, Bhabay has gone from offering to do free endorsements for brands to earning three million rupiah ($200) per video — more than half a month’s minimum wage in urban Jakarta, where she lives. With up to four sponsored videos a month, her earnings as a driver for a ride-hailing app — 50,000 rupiah (roughly $3) a day — pale in comparison.

Travel notes: Manila

Finishing with a fun one. I just love boots-on-the-ground analysis and experiences like this. I really regret not doing these types of posts myself last year when I was backpacking through Southeast Asia. Huge miss by me.

I went to Manila on a personal trip with no company meetings scheduled. But I came away more positive than before, given the rock-bottom valuations and a macroeconomic backdrop that’s likely to become more positive once interest rates come down to reasonable levels.

I’m becoming more careful of who I invest with. While the Ayalas, Razons and Gokongweis have decent reputations, other businessmen may not be as trustworthy.

And then there’s a question of politics. For now, Bongbong Marcos seems relatively hands-off. But whether he’ll eventually go down his father’s path - that remains to be seen.

Simon Torring on eCommerce in Southeast Asia [Spotify] [Apple]

Lucky enough to interview Simon Torring, Co-founder of Cube Asia, a market insights company for online retail in Southeast Asia. Cube Asia helps brands, retail companies, and investors drive profitable growth by leveraging more recent, granular, and reliable data and insights about their online sales channels.

So I picked his brain about anything and everything eCommerce in Southeast Asia. From SEA Ltd’s struggles with Shopee, to the inevitable rise of TikTok shop, if it concerns eCommerce in Southeast Asia, we got it covered.

My favourite takeaway is the eCommerce party may be over, but do you have to leave?

“we were spoiled up until about a year ago, the 10 year CAGR had been very high, 30-40-50% or something like that, an amazing growth. That's never coming back. It's gonna be more, perhaps the next 10 years will be something between 14-17% or something. So still growing much faster than retail is in these markets. It's growing much faster than GDP but that rocket growth period is over and it has very big implications for the brands that are selling because they've been used to treating e-commerce as a new venture and something where top line mattered and where profitability would be sometime in the future. And what's happening now is the top line growth party's over. It's much more now about just sustainable operations, reaching profitability and it's a very interesting moment in e-commerce.”

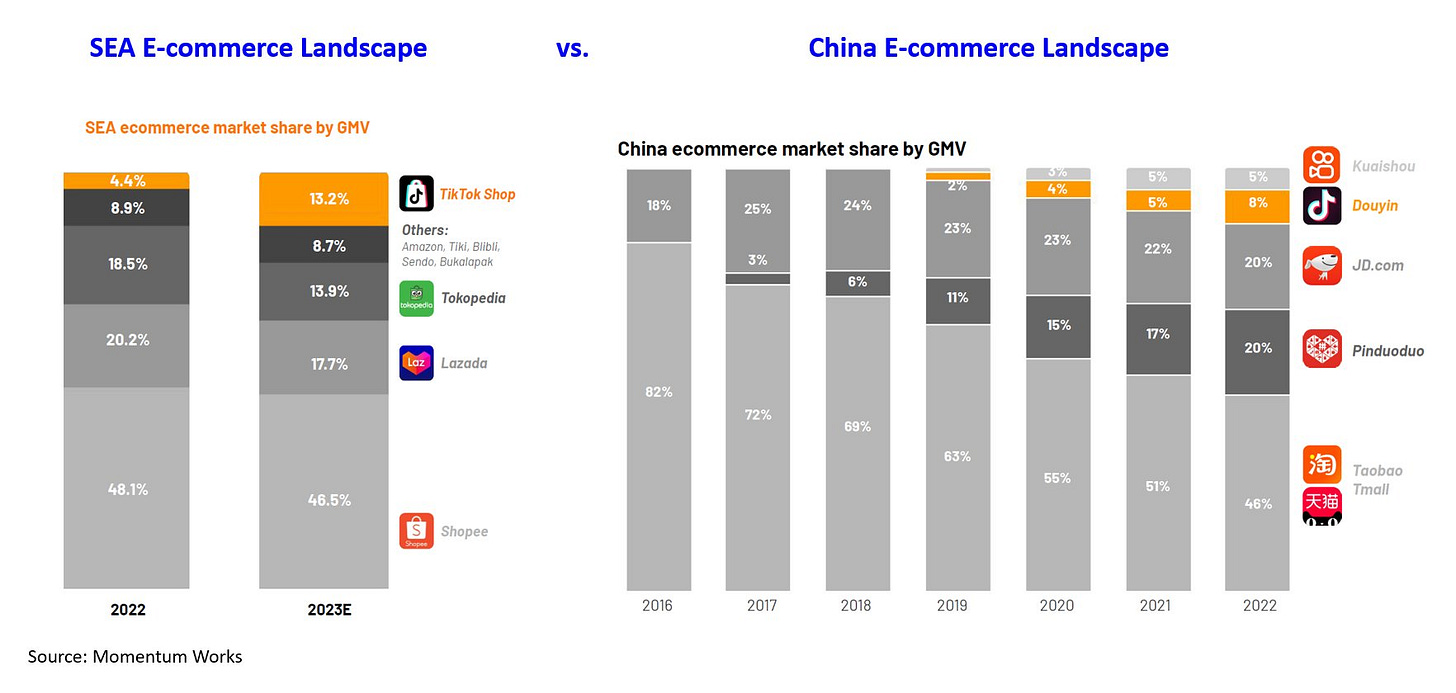

Related: This tweet from @FredaDuan

Southeast Asian eCommerce space is looking more like China now:

In just 5 years, China market went from a firm BABA 0.00%↑ & JD 0.00%↑ duopoly to a bustling market with 5 solid contenders.

The question: Is Sea Ltd shaping up to be Southeast Asia's version of Alibaba?

As public companies like SE 0.00%↑ walk the tightrope between growth & profitability, private companies (like TikTok Shop) which do not have as much concern on the burn rate are expanding aggressively.

Unit economics of TikTok Shop:

- Lower take rate: 9% for 3P platform vs. 5-7% for TikTok

- Better ROI: closed loop system; merchants advertise on-app & track conversions effortlessly

- Traffic & Acquisition: TikTok Shop's secret weapon: Ready, active users. Traditional e-comm platforms constantly battling to stay relevant w/ ads spent on META 0.00%↑ and GOOGL 0.00%↑.

Giuliano Octavianos, Head of Asia Expansion at Coinbase on just build: exploring the journeys of asia’s builders [Spotify]

Alongside Louis from Math Not Magic who I shared at the very start of this article, Joyce Lee is another Singaporean wunderkind destined (and on track) for great things. (We all had a coffee together and boy did I feel like a fish outta water!)

Beyond cool to see her launch her own podcast! I know how tough and daunting it can be to start a podcast, so be sure to check the podcast out and show some support if you love it like I do!

Turn off your clickbait title detector for a few seconds, because this video is so extremely based.

99% of success advice is for normies who are okay with settling. And I was not okay with settling, so I followed the 1% batch of crazy advice. Warning, if you don't have an open mind, you're going to think this video is crazy

TL;DW?

Focus on earning more and not saving or spending less. Instead of thinking, how can I save an extra 100 this month? Think, how can I make an extra 100 this month? Because making money is a lot harder than saving it.

Realize that you don't get like an assistant or a house cleaner or, you know, employees when you make X amount of money. Getting those things is how you make X amount of money. Because outsourcing frees up your brain and frees up your creative energy.

Words are spells. I realized that my negative money talk was manifesting in real life.

Rich people have nicer but less things. You will feel so good and so luxurious and your actions will follow.

Lower your stimuli. Put your phone in black and white. Don't watch the news. I haven't watched the news in probably a year. You'll Don't doom scroll. Sit in silence. Meditate. Do yoga. Mindfulness. Lower your stimuli.

Have a why. I was in a job where I was treated unwell, and I couldn't leave because I didn't have the money. Money gives you options to leave bad situations.

Everything is an investment. What you read, who you hang out with, your biggest asset is your attention. Invest it wisely.

You need a fallback. You can't make good decisions in survival mode, and this is why I failed in entrepreneurship in the past several times, because I was always in survival mode because I didn't have a monetary fallback.

You have to take massive ownership of your situation. Massive. Say it with me, my life is a direct result of my past actions. If you don't agree with that statement, you've already taken the L. Sorry. And I know what you're gonna say. “I'm not responsible for blah blah blah blah blah this horrible situation I am I was in. I'm not responsible for where I come from”. Of course, you're not responsible for that. But you have to take responsibility for it in order to move forward. I know that fucking sucks, but you have to.

Don't spend money on things just because society says so or your culture says so. Basically, just question everything.

Get out of the consumerism mindset ASAP. Unfollow all brands. Rip the labels off shit that you buy. Unsubscribe from brand emails. Shop at brandless places like the farmer's market.

You will be successful if you believe you can be successful. And you will fail if you believe you will fail. It's your choice.

Building a resilient PE business in Asia - fireside chat with Tracy Ma, Hillhouse Capital

I’ve previously dived deep into the life of Zhang Lei. But the story behind Tracey Ma, his first employee, who is now a partner and COO, is just as interesting.

At the time I called an old classmate and asked him to join. He refused but recommended his wife. I asked: "Are you serious? You refused me and 'threw' your wife over?" His answer at the time was very objective and sincere: "I'm already a partner in a large law firm!"

And this video has only barely cracked 1,000 views on YouTube! How blessed are we. So this is the perfect chance to hear first-hand how Hillhouse has developed over the years.

Malacca: The Strategic Significance of the Strait

My latest YouTube video based on Colin R. Powrie’s excellent post, Malacca Strait: why does up to 40% of global trade flow through here?

[READ] This Is Not a T-Shirt by Bobby Hundreds

Half memoir of Bobby, half business history of The Hundreds. Success, failure, and lessons learned in building a streetwear business.

Definitely recommend it if you’re looking to learn about building a brand and community, as Bobby has done it from the ground up.

The best and worst thing about entrepreneurship is that there are no rules. There's a history behind you to acknowledge, learn from, and build off, but you also don't want to follow the blueprint too closely; the past is in the past.

Every generation progresses by questioning tradition, reinterpreting established practice, and adding its voice and style. It takes balls to forge new territory. It takes guts to say no to best practices. Whenever up-and-coming entrepreneurs ask me what it takes to gain the industry's recognition, I say,

"You shouldn't care about earning their respect. You should be doing everything in your power to piss them off."

On my side Substack, I’ve compiled all my takeaways.

[READING] Total Recall: My Unbelievably True Life Story by Arnold Schwarzenegger

A big bastard of a book, but an enjoyable read. The dude gets after it, and markets himself well. When Arnold finishes recording his scenes for a movie, the work isn’t even remotely done. He’s doing non-stop interviews and travels not just in the US, but everywhere overseas too. He saw the value in foreign audiences well before others did.

Early to bed, early to rise, work like hell, and advertise

And,

“it's not what you get out of life that counts. Break your mirrors! In our society that is so self-absorbed, begin to look less at yourself and more at each other. You'll get more satisfaction from having improved your neighborhood, your town, your state, your country, and your fellow human beings than you'll ever get from your muscles, your figure, your automobile, your house, or your credit rating”

Apologies for the radio silence on my end since the May email, been a little busy!

In a change-up, I’ve been working on a side passion of mine, building a golf brand. I love golf. Like I’m playing 4-5 times a week. And the days I’m not I’m thinking about it 24/7.

My simple solution to a problem I’m solving is: golfwear fucking sucks.

It’s either boring as batshit company logo polos for fat old dudes, or over-the-top tacky ass designs for frat bros.

We can do better than that.

So hand-designed, hand-screenprinted by me, with a solid personal touch is what I’m trying to achieve!

Slow and steady wins the race and I’m hoping by December I’ll be able to start slinging out some polos and shirts for those in the know :)

I’m not really a poem guy, but today I’ll finish with one. My takeaway is that just because something special ends, doesn’t mean it was a waste. So if my foray into golfwear crashes spectacularly, I won’t even be mad because this steep learning curve has been a bloody fun one.

“Anything worth doing is worth doing badly”

You can find previous posts here. I also interview legends at Compounding Curiosity, and lurk on Twitter @scarrottkalani.

Want to get in contact? Reply to this email, comment on Substack, or send a letter via carrier pigeon and trust that fate will deliver it.

excellent stuff as always, good to have you back!

Super cool Kalani - thanks for sharing!