Stock Selection Frameworks and Masayoshi Son

Wherever it goes, it goes

Dirty #30! Let’s go. As always, I’m keen to share what I’ve been reading, learning, and compressing. But first, a quick quote from golfing legend Dustin Johnson:

I just hit shots. Wherever it goes, it goes.

Here’s the format of today’s email:

Part 1: Stock Selection Frameworks

Part 2: Under the Spotlight: Masayoshi Son

Part 3: Bonus Quirky Content - Something to Read, Watch, and Listen

Stock Selection Frameworks

Apologies in advance for those with average eyesight and those on mobile. Some of these graphics aren’t the easiest on the eyes in small pictures. But still super valuable I think!

Pro Tip: If you click on any of the images it *should* take you to a full-size file.

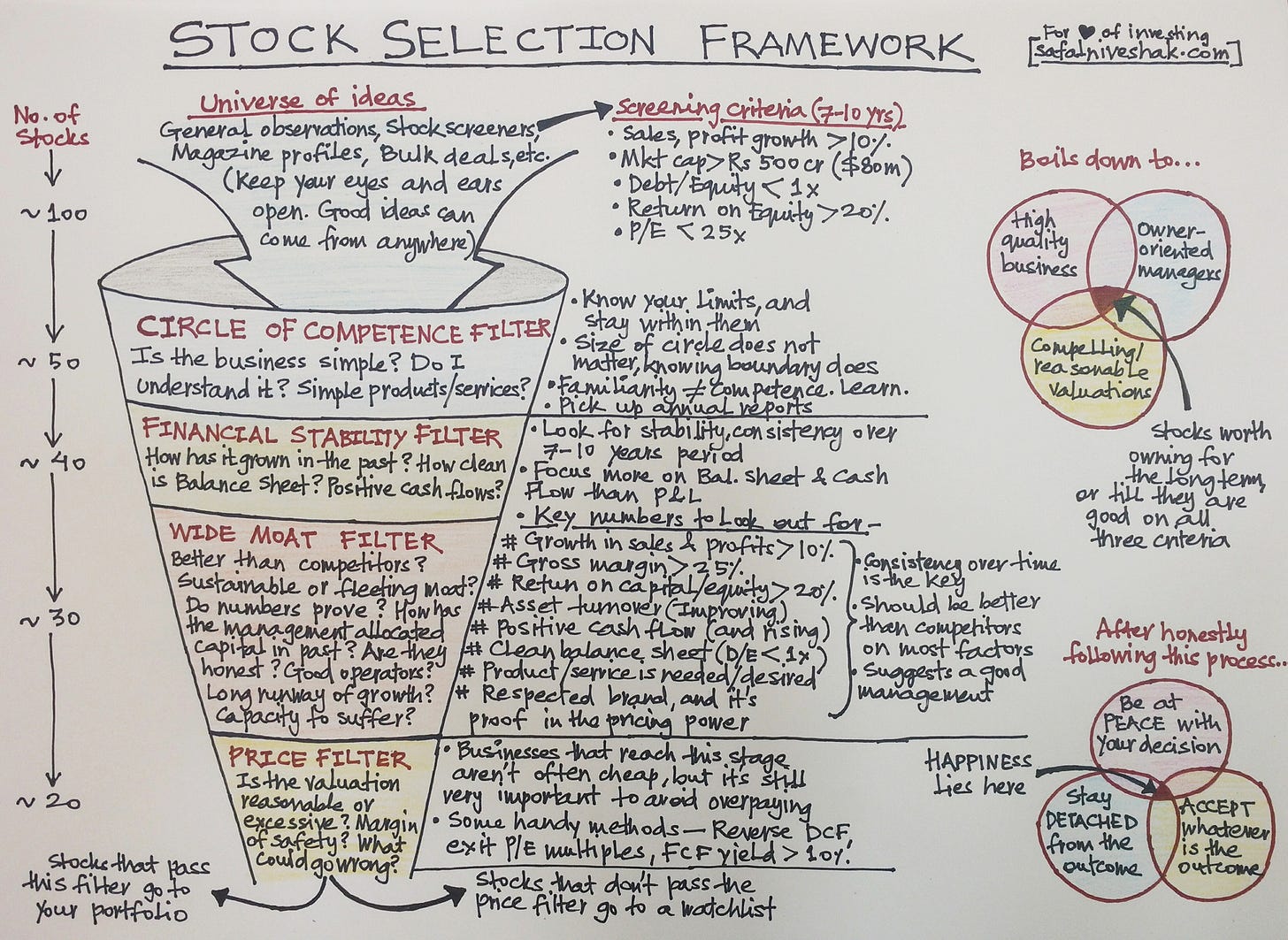

Safal Niveshak [Link]

This is art. Frame it and put it in a museum. The graphic, the explanations, the style. GOAT framework.

One small gripe with stock screens is that things will slip through that shouldn’t. And will often miss quality companies. But overall screens are great for a quick and dirty look.

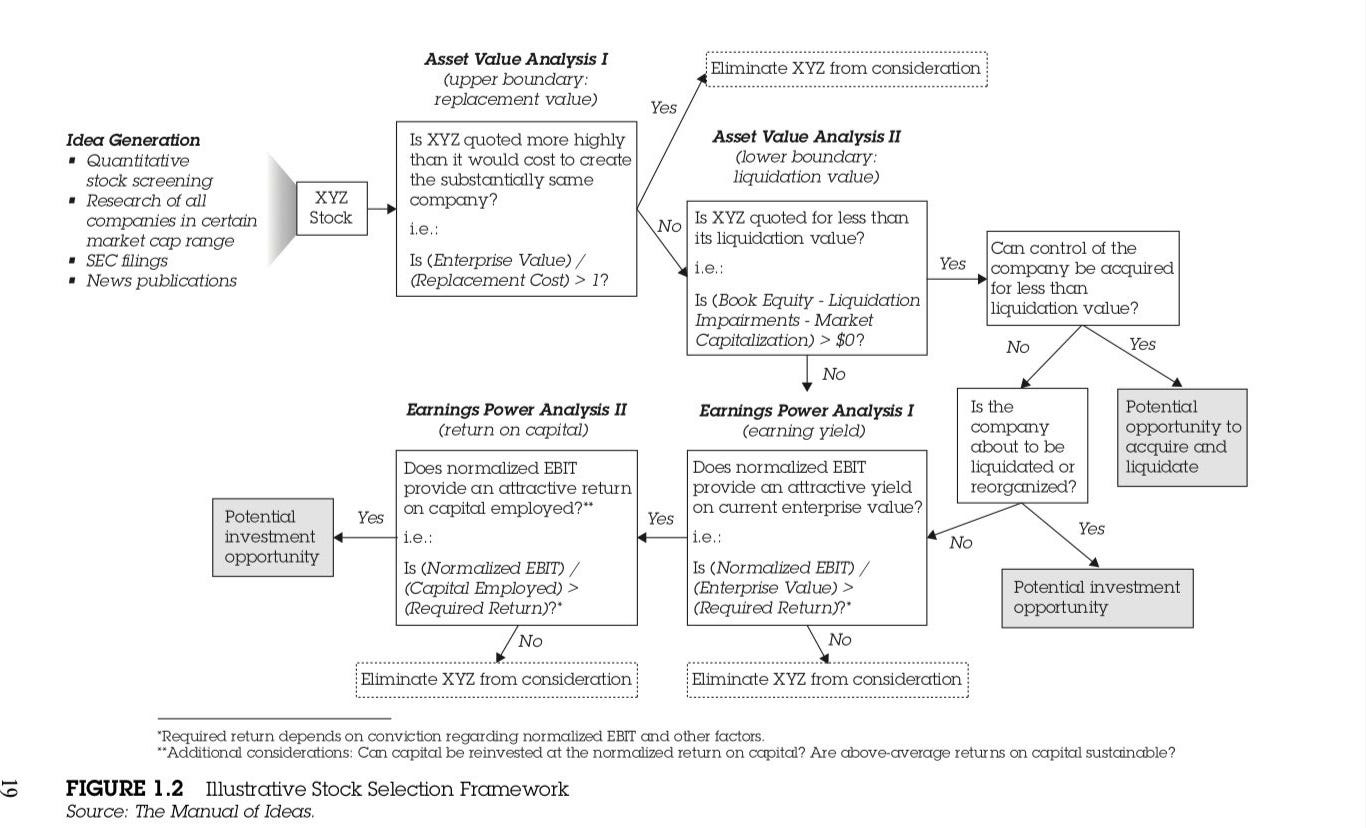

Manual of Ideas [Link]

Incredible book. John (@JMihaljevic) has done an incredible job. A great guide on investing that I think will stand the test of time. Genuinely believe that. John being a good bloke is just a bonus!

I like this flowchart idea too. Gives a glimpse as to where the thought process leads.

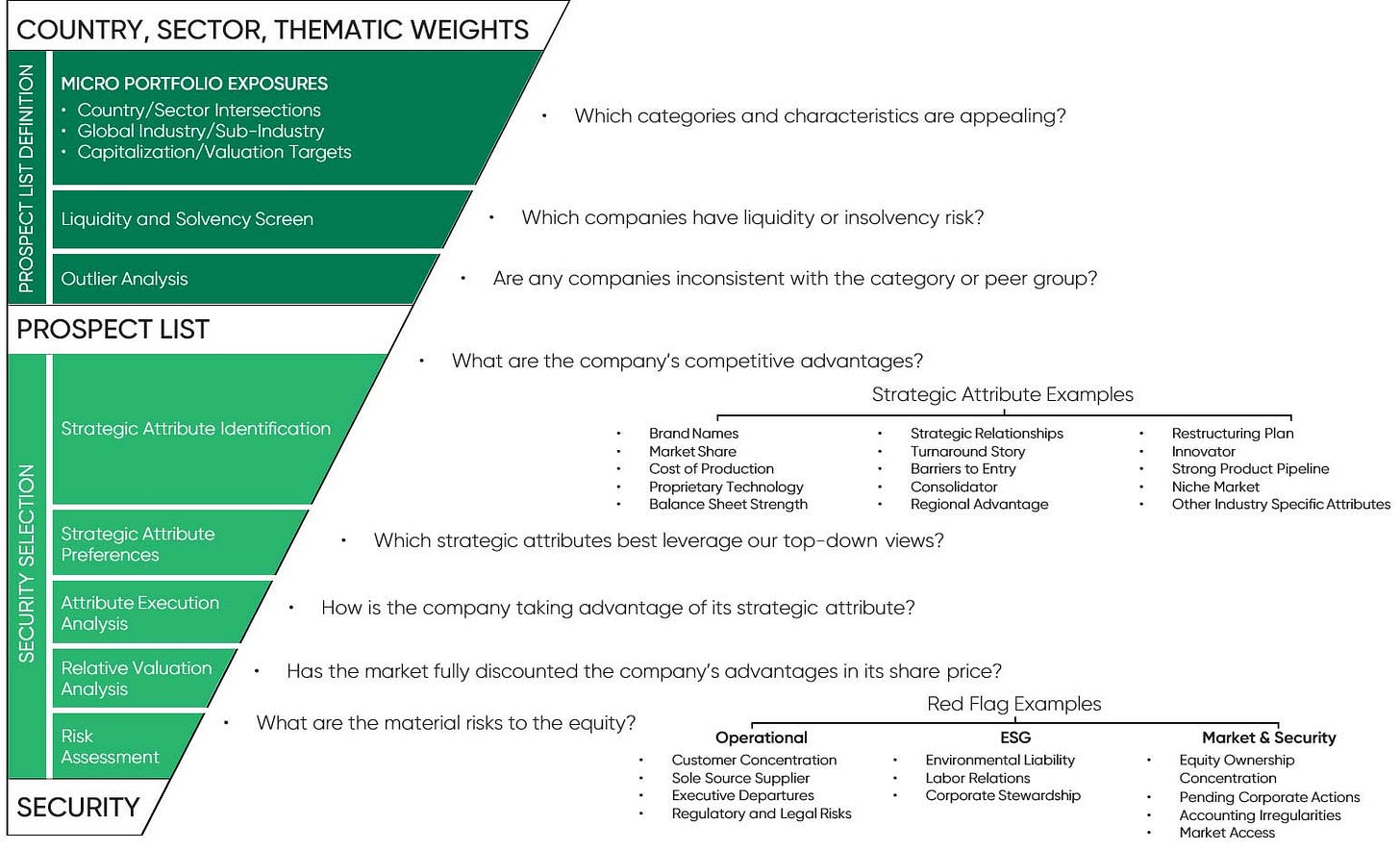

Ensemble Capital

Ensemble Capital also has a great PDF on position sizing which I recommend downloading.

Fisher Investments [Link]

Venture Investing Framework [Link]

There’s a tonne of great graphics in this article! Highly recommend giving it a look through.

There is a consistent, formulaic approach to evaluating the viability of a startup.

That approach deals with identifying high quality businesses with the following four characteristics:

A company with a strong team, a valuable offering that meets customer needs, and a viable business model

Differentiated in an industry with barriers to entry and limited pressure on profitability

In a sufficiently large, growing, and penetrable market

With an attractive risk / reward profile justified by a unique advantage

Endowment Basics

Ok, not a stock selection framework. But similar to the HoF hand-drawn framework we started with, thought this would be a neat way to wrap up! This whole thread I think is a perfect example of teaching someone from zero to seven-out-of-ten. I started with zero knowledge about Endowments, but now I’m on that first peak of the Dunning-Kruger curve babyyyyyyy.

Endowments are managed to exist in perpetuity. Forever.

Under the Spotlight: Masayoshi Son

Each week I provide a little spotlight on an investor or operator I admire.

Masayoshi Son is this weeks focus, in a nutshell:

Born in Japan but is a Zainichi Korean (Japanese people of Korean descent). Recommend reading the wiki entry to understand a little history behind Zainichi Koreans.

At 16, he moved to California and finished high school in 3 weeks. Would later study at UC Berkeley and major in Economics and Computer Science.

While at Berkeley, Masa created an electronic translator which was acquired by Sharp:

"While I was at Berkeley, I had 250 inventions that I wrote down in my “Invention Idea Notes.” Then I picked one to develop a prototype and apply for a patent. I made close to $1 million by selling the patent to Sharp."Then made another million odd dollars from importing Japanese video game machines:

"I remodeled the software on game machines that I had brought from Japan and installed them in restaurants, cocktail lounges, dormitories, and cafeterias. I made another $1 million from that"In 1981, he founded Softbank, when he was only 24 years old. I’m 25 FYI. But I have like 800 email subscribers so who’s the real winner here?

Softbank is best known for its Vision Fund, the world’s largest tech VC fund, with over $100bn in capital. Masa is best known for his early investment in technology companies, including his $20m investment in Alibaba in 1999

HBR Interview [Link]

This interview is from 1992, but so worth your time. Masa plays the long game like you wouldn’t believe. How he started Softbank is wild:

I read all kinds of materials to prepare for what I would do for the next 50 years.

I came up with 40 new business ideas—everything from creating software to setting up hospital chains, since my wife’s father is a doctor and has a hospital. Then I had about 25 success measures that I used to decide which idea to pursue. One success measure was that I should fall in love with a particular business for the next 50 years at least. Very often, people get excited for the first few years, and then, after they see the reality, they get tired of the business. I wanted to choose one that I would feel more and more excited about as the years passed.

Another factor was that the business should be unique. That was very important to me. I didn’t want anyone else doing exactly the same thing. A third was that within 10 years I wanted to be number one in that particular business, at least in Japan. And I wanted to pick a business where the business category itself would be growing for the next 30 to 50 years. I didn’t want to choose a sinking ship.

I had all those measurements, about 25 in all, and 40 new ideas. I took a big sheet of paper, and I drew a matrix and put down scores and comments for each. Then I picked the best one, which turned out to be the personal computer software business. That was the start of Softbank.

Without getting too mushy, but man this anecdote made me kind of sad. Poor bloke is just having a red hot crack. And people laughing, calling him dumb.

What happened after the show? [the trade show where he only made back one-twentieth of the cost of the booth]

After that, many people were laughing at me. They said, that guy’s really dumb. He’s a nice guy but dumb. I said, OK, I’m dumb. But I’m going to keep at it, and someday, somebody will find out what I can do

I don’t wanna be a billionaire bootlicker, but seriously, what a guy. Good on him.

I had a very long-term vision. I didn’t have any evidence, but I believed in myself. I believed that someday I would have a very big company, a global business, and a very successful company.

Time Machine Management

The theory is that US is the future, and every other country will go through the same technology transition as the US. So if you know what's successful in the US, investing in other geos is like going back in time in a time machine.

Allowed him [Masa] to get Alibaba in the bag back in the day. And as a result the idea is surprisingly influencial in Asia investment circles.

Masa Madness [Link]

More of a look at Softbank with a hint of Masa. But worth a read nonetheless.

I probably wouldn’t bet on Masa the Investor. There are very few people I’d want to back more than Masa the Entrepreneur.

Learning from Mistakes [49 mins]

I'm born and raised with no street number. Okay, so I start from nowhere. I wanted to become some meaningful guy at least with the street number.

Bloke gets ragged on Twitter a bit for his kooky optimism. But I dunno, I think I’m a fan. Unless he’s absolutely pulled the wool over my eyes, I’m happy for the guy. Inb4 being called a billionaire shill.

Loved this comment from YouTube: “He makes bold bets and humbly admits his mistakes if he does. He continues to invest and strives to make this world a better place.”

Honestly, what more can ya want from the bloke?

Bonus Quirky Content

Something to read: How to Configure Your iPhone to Work for You, Not Against You [Link]

In terms of articles that have caused me to make a number of changes, this article is #1.

My recommendations: Set up text replacement shortcuts, Automatic Do Not Disturb at night, turning off Raise to Wake, and be strategic about your wallpaper.

Something to watch: Skateboarder’s Unbelievable Survival Story | Ross Capicchioni [14 mins]

Broad title because I won’t give too much away. But damn. I want this guys mindset to life. Incredible story and outlook.

Something to listen to: James Clear on Creative Elements [Link] [Apple Link]

James has a few good podcast appearances around. So if you’ve listened to others I wouldn’t say this is required listening. But for me was a good refresher. Covers writing his book, the sacrifices required, and what it means to do A+ work.

in any domain, only a few things matter, but only the expert knows what to ignore. […] focus is the art of knowing what to ignore. But you only gain that ability, you only master that art with experience.

Something to listen to (from me): Eugene Ng on Compounding Curiosity [Link] [Apple Link]

Super stoked to have been able to do this one! Eugene’s investment knowledge coupled with his story is an absolute treat. And you also get his infectious enthusiasm and positivity! I’m too damn lucky to be able to do these podcasts. They’re like a cheat code to life.

the very simple math of the greatest investors in the world, they’ve been the greatest investors in the world is because they have been investing long-term. They have track records of 15, 20, 25 years, 30 years. Right? The whole thing about investing is not just being the winner in a one year race. It’s about really being the winner in a very long race. So all I’m trying to do is, remove all of these things and to just reduce odds of failure.

You can access the transcript for this episode here.

Rabbit hole/resource to dive into: Brett Bivens’ “Rise of Company X” [Link]

Ever wonder how some of the worlds best businesses got started? Look no further. An incredible resource of articles of businesses that help explain their early strategy, culture, and competition. Really cool to look at with the benefit of hindsight.

Final thought for the week:

Until next week, have a good one!

- Seagull Scarrott

You can find previous issues of Curated by Kalani here. I’m on the web at kscarrott.com, interviewing at Compounding Curiosity, and on Twitter @scarrottkalani.

Liked this post? Why not sign up.

Hey Kalani,

Yours is one of the few rare newsletters which light me up as soon as they arrive in my inbox.

But with this newsletter on Stock Selection Framework and Masayoshi Son, you’ve bulldozed everything else.

Keep up the great work pal! With you, we grow together.