Welcome to issue number one! I’m really excited to share what I’ve been reading, learning, and compressing. Hoping this can be a huge value to you too.

Since this is my first issue, I’d really appreciate any feedback!

Here’s the format of today’s email:

Part 1: Amazon - Flywheels, Amazon Prime, and Jeff Bezos.

Part 2: Memo Madness - A couple of my favourite memos.

Part 3: Under the Spotlight: Li Lu - Lessons from my favourite investor.

Part 4: Bonus Quirky Content - Something to Read, Watch, and Listen.

Amazon

Amazon, A Multi-Trillion Dollar Company?

Back in 2016, Chamath’s Social Capital put together a presentation with a bold call that Amazon will be a $3T company by 2025. At the time, AMZN had a $356 Billion Market Cap. Today? AMZN has a $1.6 Trillion Market Cap.

It’s almost as if Amazon constantly asks themselves “how can we turn our biggest costs into a source of cashflow?”.

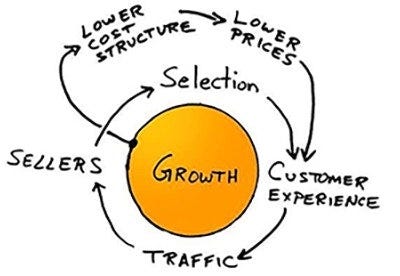

They not only turn costs into cashflow, but then scale like crazy and get their flywheel cranking.

Amazon loves building scale at all costs; wielding the capital intensity and costs of that scale as barriers-to-entry. Time after time, Amazon’s endgame has been to provide B2B customers with outsourced economies of scale and operating leverage, which reflexively increases Amazon’s own scale. - Source

If you’re not already following @borrowed_ideas on Twitter, you should be.

The Making of Amazon Prime

Jeff Bezos was an absolute force behind pushing it through to completion. Also, his ability to think about the problem differently than others and to back himself in his vision. Super interesting and inspiring.

I’ll always remember, I presented the numbers to Jeff Bezos and I said, “This is what Prime is going to cost because of the percentage by air.” And Bezos said, “You aren’t thinking correctly.”

It was a self-fulfilling prophecy: If customers liked Prime, the demand would go up. And because the demand would go up, we had more freedom to build new fulfillment centers.

That’s why he’s a genius and I’m just an operations guy.

From a different article, but this quote highlights how genius Prime membership is:

When Amazon first created Prime, in 2005, Bezos insisted that the price be set high enough that the program felt like a genuine commitment. Consumers would then set out to redeem this sizable outlay by faithfully consuming through Amazon. One hundred million Prime subscribers later, this turned out to be a masterstroke of behavioral economics. Prime members in the U.S. spend $1,400 a year on Amazon purchases, compared with $600 by nonmembers, according to a survey by Consumer Intelligence Research Partners. It found that 93 percent of Prime customers keep their subscription after the first year; 98 percent keep it after the second.

Amazon and Invisible Asymptotes

My BizCard below might be a handy recap of the article. But one key point I want to highlight is: Amazon is a behemoth at smashing through ceilings on their growth curve.

Besides the education and information value from the article, this tidbit is great (there’s always one person!):

For a window of time in the early days of Amazon, if you shipped us a box of books for returns, we couldn't easily tell if you'd purchased them at Amazon and so we'd credit you for them, no questions asked. One woman took advantage of this loophole and shipped us boxes and boxes of books. Given our limited software resources, Jeff said to just ignore the lady and build a way to solve for that later. It was really painful, though, so eventually customer service representatives all shared, amongst themselves, the woman's name so they could look out for it in return requests even before such systems were built.

Jeff Bezos’s Master Plan

A phenomenal 10,000+ word deep dive into trying to understand more about Jeff Bezos the person and what his endgame might be.

Bezos was hardly a mellow leader, especially in the company’s early days. The journalist Brad Stone’s indispensable book about the company, The Everything Store, contains a list of Bezos’s cutting remarks: “Are you lazy or just incompetent?” “This document was clearly written by the B team. Can someone get me the A-team document?” “Why are you ruining my life?” (Amazon says this account is not reflective of Bezos’s leadership style.) This was the sarcastic, demeaning version of his endless questioning. But Bezos’s waspish intelligence and attention to detail—his invariable focus on a footnote or an appendix—elicited admiration alongside the dread. “If you’re going in for a Bezos meeting, you’re preparing as if the world is going to end,” a former executive told me. “You’re like, I’ve been preparing for the last three weeks. I’ve asked every damn person that I know to think of questions that could be asked. Then Bezos will ask you the one question you hadn’t considered.”

Later in the article, it mentions how Bezos’ has built Amazon to be anti-bureaucracy, by implementing “two-pizza teams”. Basically, teams at Amazon should be small enough to be fed with only two pizzas.

Simple, fast, and efficient.

Amazon’s Leadership Principles

Now, this might be common knowledge for some, but this has been my first time seeing this document. And of course, it’s easy to say all these things, but Amazon does have the track record of actions backing these words.

Every week I share a compilation, some resources, and interesting links.

If you would like to receive it directly in your inbox, subscribe now.

Memos

You like Memos? Well, do ya punk?

Sam Hinkie's Resignation Letter

Business and sports are more alike than I think people realise, and Hinkie has a way of combining lessons from both in an entertaining and informative way.

Sam is a great example of how I strive to behave:

Constantly curious,

Playing long term games, and

Acting with humility

Lifelong learning is where it’s at. To walk down that path requires a deep-seated humility about a) what’s knowable, and b) what each of us know. We hire for this aggressively. We celebrate this internally. And we’ve been known to punish when we find it woefully lacking.

We talk a great deal about being curious, not critical. About asking the question until you understand something truly. About not being afraid to ask the obvious question that everyone else seems to know the answer to. And about the willingness to say three simple words, “I don’t know.”

And the spirit of an Amazon themed edition…

Stevey Yegge’s Google Platforms Rant (with Amazon comparisons)

My tech knowledge is severely lacking, but this is a pretty cool insight even with my limited knowledge.

Bezos realized that he didn't need to be a Steve Jobs in order to provide everyone with the right products: interfaces and workflows that they liked and felt at ease with. He just needed to enable third-party developers to do it, and it would happen automatically.

Give the people what they want and gtfo the way. It’s so simple yet so effective. Power to the people.

Jeff Bezos is an infamous micro-manager. He micro-manages every single pixel of Amazon's retail site. He hired Larry Tesler, Apple's Chief Scientist and probably the very most famous and respected human-computer interaction expert in the entire world, and then ignored every goddamn thing Larry said for three years until Larry finally -- wisely -- left the company.

Bezos is super smart; don't get me wrong. He just makes ordinary control freaks look like stoned hippies.

A great resource for memos is @sriramk’s site (link). Hopefully one day I can build a collection as good, if not a little bigger! So feel free to send any memos through you think are interesting!

Under the Spotlight: Li Lu

Each week I’m going to provide a little spotlight on an investor or operator I admire. And Li Lu’s story is just something else. In a nutshell:

Born at the dawn of the cultural revolution with his parents and grandparents taken away simply for being intellectuals. Spent most of his childhood rotating between adopted families of peasants and coalminers.

Survived the Tangshan Earthquake which killed over 200,000 people.

One of the leaders of Tiananmen Square protests.

To being the only individual Charlie Munger is invested with.

Woody Allen is right, 90% of success is to show up. At various stages in my life, I could have stopped, or took the long rest. For some reason, my heart told me otherwise. I just kept going. Half of the time, I wasn’t sure where I was heading. The other half I was probably taking the wrong turns. It doesn’t matter. - Li Lu’s Reflections on Reaching Fifty

Li Lu’s Value Investing Insights

Some of my notes on Li Lu’s speech he did at San Francisco State University in 2012.

Value has traditionally outperformed. So why do so few people do it?

Value investing has been well practised and well-publicised for a while now. But Li believes it comes down to simple human psychology. You need to have a frame of mind where you are comfortable standing alone against the crowd.

What type of business does Li invest in?

Enduring earnings-generating businesses. Compounding machines.

You want to combine a cheap priced asset, which is still of quality but then add the ability to generate cash on a consistent basis. Then hold on for the longest period of time. Because no matter what the market does, you can ignore it. You’ve found your unicorn.

Do situations like that even exist?

Li argues it does. Maybe not for large amounts of capital but they are around.

If he was a student and investing now, he would be extremely happy with the options presented. With smaller pools of money, there’s plenty of pockets of opportunities.

And one of my favourite Li Lu quotes:

Ideas come to me from all sources, principally from reading and talking. I don’t discriminate how they come, as long as they are good ideas. You can recognize good ideas by reading a great deal and also by studying a lot of companies and constantly learning from intelligent people – hopefully more intelligent than you are, especially in their field. I try to read as much as I can. - Source: Graham & Doddsville Spring ‘13

Want a 300+ page compilation of Li Lu articles, posts, and translated works?

See this source. H/T @kgao1412

Bonus Quirky Content

Something to read: MTG: Magic: The Gathering and MeTaGaming - Not something I’m usually interested in or would read, but super fascinating and great insight.

Users will understand if you monetise, but get upset if you're too aggressive. Think a rake too far.

The response to a mistake can be more important than trying to avoid the mistake. Think about actual apologies vs lip service.

Community run groups that are linked to an official organisation will be forced to defer to the organisation. Think about responsibility vs authority and who actually has what.

Something to watch: The Porter: The Untold Story at Everest (2020) - Nepalese porters are essentially mountain couriers. This type of content is exactly why I love YouTube. A slow burn documentary at 50 minutes long, but truly a unique perspective into the life of a Porter. A doco that is one of a kind and hard to replicate.

Porter life is extremely hard. Because the salary is so small that you can't eat enough.

Just 1500 rupees a day and with that you can't eat enough food.

Tips come on the last day. If they don't give tips, then we work for free.

And,

Without Porters, this whole trekking area wouldn't work. It just wouldn't work.

Tourists can't carry loads. Guides won't carry loads.

Without Porters, there's nothing.

Something to listen to: Sam Hinkie - Find Your People (Spotify Link)- I’m a big fan of the process.

People are really a power law, and the best ones can change everything. Betting on people who have these incredibly high ceilings and a reasonably high likelihood of getting there I think is much of where the game should be, even more than most.

Until next week, have a good one!

- K

You can find previous issues of Curated by Kalani here. I’m on the web at kscarrott.com and on Twitter @scarrottkalani.

Liked this post? Why not sign up.